Article -> Article Details

| Title | A Brief Overview of the Steel Industry in South Africa​ |

|---|---|

| Category | Business --> Business and Society |

| Meta Keywords | Steel Industry,South Africa​ |

| Owner | Sinosteelpipe |

| Description | |

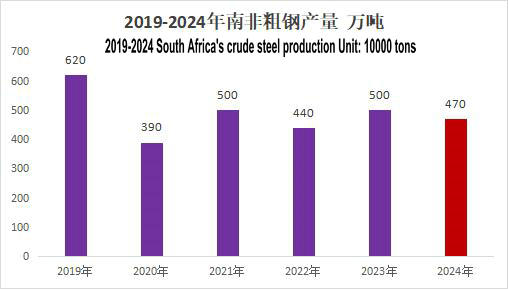

I. Current Status of the Steel Industry in South AfricaSouth Africa was once a leader in the African steel industry. In the 1980s, its crude steel production accounted for over 70% of Africa's total output. Relying on abundant iron ore and chromite resources, the country established a complete steel industry chain. According to data published by the World Steel Association (WSA), South Africa's crude steel production in 2024 reached 4.7 million tons, ranking 29th globally and second in Africa, following Egypt.

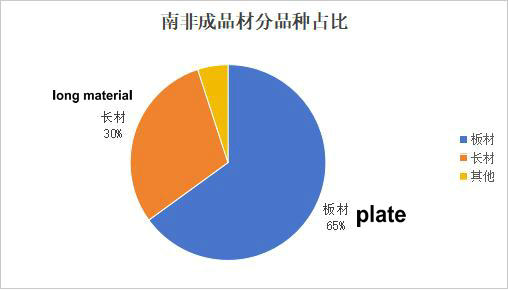

In terms of production structure, South Africa's steel production is dominated by flat products (such as hot-rolled coils and cold-rolled sheets) and heavy sections, primarily used in mining and automotive manufacturing. According to statistics from World Metal Bulletin, flat products currently account for as much as 65% of South Africa's finished steel output.

Steel companies are mainly concentrated in Gauteng Province (around Johannesburg) and KwaZulu-Natal Province (Port Durban), leveraging mineral resource advantages and port logistics. AMSA has long held over 70% of South Africa's market share and once dominated the market. However, due to high costs and import competition, it was forced to close its long steel business, exposing the vulnerability of local enterprises. The remaining production capacity is scattered among small and medium-sized steel mills (approximately 50), most of which face survival pressures due to their small scale and outdated technology. II. Consumption Structure of Steel in South AfricaIn 2024, South Africa's apparent steel consumption is estimated at approximately 4.8 million tons, a year-on-year decline of 3%, mainly due to reduced mining investments and a sluggish construction sector. The government's proposed infrastructure plans (such as port expansion and renewable energy projects) are progressing slowly, and steel consumption in 2025 is expected to grow by only 1%-2%. South Africa's manufacturing industries, including automotive, home appliances, and machinery, have significant demand for steel. The automotive industry holds an important position in South Africa's economy, accounting for 6.4% of GDP and 11.8% of total exports. Automotive manufacturing requires large amounts of steel for the production of vehicle bodies, engines, chassis, and other components. Additionally, home appliance manufacturing, metal tools, and equipment production also consume substantial amounts of steel. Data shows that in South Africa's downstream steel demand industries, the manufacturing of automobiles, home appliances, and wires accounts for approximately 54.8% of total steel demand. The construction sector is another important consumer of steel in South Africa. The South African government prioritizes infrastructure development, and the continuous construction of urban housing, roads, bridges, and other infrastructure projects has driven strong demand for steel products such as rebar and rails. III. Chinese Steel Exports Account for 42% of South Africa's Steel ImportsIn 2024, South Africa's steel imports are estimated at approximately 3.26 million tons, a 105% increase compared to 2021 (source: South African Iron and Steel Institute, SAISI). China accounts for 42% of these imports, primarily supplying flat products and wire rods, followed by India and Turkey. The self-sufficiency rate for high-end specialty steels (such as galvanized sheets and silicon steel used in automobiles) is less than 20%, with South Africa relying heavily on imports from China, Germany, and Japan.

Sinosteel Stainless Steel Pipe is the Manufacturer and Supplier of Stainless

Steel Pipe and Special Alloy Pipe, Steel pipes with an outer diameter from

8mm to 3600mm, with wall thicknesses from 0.2mm to 120mm. Factory covering an area of

333,000 square meters. Production capacity reaches 200,000 tons. | |