Article -> Article Details

| Title | Overview and Development Prospects of the Indian Steel Industry |

|---|---|

| Category | Business --> International Business and Trade |

| Meta Keywords | Steel Industry,Indian |

| Owner | Sinosteelpipe |

| Description | |

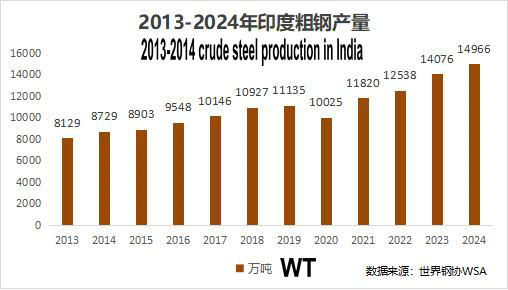

| In recent years, the Indian steel industry has continued to show a strong growth momentum and has become a remarkable highlight in the global economy. The types of Indian steel products are rich, covering a complete production line from raw materials to finished products, including galvanized steel plates, seamless pipes, high - speed steels, stainless steels, and cold - rolled plates. These products are widely used in many fields such as the construction industry, machinery manufacturing, the automotive industry, the aerospace industry, and the crude oil and natural gas industry. This diversification and comprehensiveness of the Indian steel industry provide strong support for its competitiveness in the global market. I. India's Steel Production CapacityIndia's crude steel output has ranked second in the world for many consecutive years. In 2018, India's crude steel output reached 109.3 million tons, surpassing Japan (104.3 million tons) for the first time and becoming the world's second - largest crude steel producer. It has maintained this position for six consecutive years. According to data from the World Steel Association, in 2023, India's crude steel output reached 141 million tons, a year - on - year increase of 12.3%, accounting for 7% of the world's crude steel output. In 2024, the output reached 145 million tons, a year - on - year increase of 3.6%. It is expected that the production capacity will reach 205 million tons in 2025, and the goal is to break through 300 million tons of production capacity by 2030.

II. The Main Distribution of India's SteelThe core areas of India's steel industry are divided into:

The main steel mills are as follows:

III. Situation of Iron Ore Raw Materials in India1. Iron Ore Supply PatternAccording to data from the United States Geological Survey (USGS), although in terms of the proven reserves of mineral resources, India ranks sixth in the world in terms of the total proven reserves of iron ore, coming after Australia, Brazil, Russia, China, and Canada. However, in terms of production, during the fiscal year 2023 - 24, the iron ore output reached a record high of 274 million tons. In the fiscal year 2024 - 25 (from April to January), the iron ore output further increased to 236 million tons, a year - on - year increase of 3.5% compared with 228 million tons in the same period last year. This growth rate shows India's steady growth trend in global mineral production, especially against the backdrop of the increasing demand in the steel industry, where the production of iron ore maintains strong momentum. 2. Current Situation of Iron Ore Production in IndiaThe sources of iron ore production in India are mainly concentrated in the top four provinces. Odisha province has the highest output, with a total output of 110 million tons in the fiscal year 2023, accounting for more than half of the national output. Ranked second is Chhattisgarh province, with an output of 36.98 million tons, accounting for about 18% of the national output. The third is Karnataka province, with an output of 34.54 million tons, accounting for about 17% of the national output. The total output of the top four provinces (Odisha, Chhattisgarh, Karnataka, and Jharkhand) accounts for about 96% of the national total. In terms of mine ownership and scale characteristics, there were a total of 273 operating mines in India in the fiscal year 2023, of which 41 were state - owned and 232 were private. Although there are more private mines, their average scale is relatively small. Moreover, whether private or state - owned, large - scale mines (with an annual output of more than 1 million tons) remain the main source of production in India, accounting for more than 80% of the national total. Looking at the specific data, among state - owned mines, there are 19 mines with an annual output of more than 1 million tons; among private mines, there are 34 mines with an annual output of more than 1 million tons. The annual output of these 53 large - scale mines accounts for 88.68% of the total. In addition, the annual output of iron mines owned by steel mills is 83.01 million tons, accounting for 40.60%; the annual output of other independent mines is 121 million tons, accounting for 59.40%. The top domestic enterprises in India account for more than half of the country's main output. According to the latest data from SteelMint, there were five enterprises in India with an iron ore output of more than 20 million tons in the fiscal year 2023, and the total output of these five enterprises accounted for about 65% of India's national output. Moreover, some relatively large - scale mines are similar to Chinese mines and are also owned by steel mills, and their output is mainly consumed by the group's own steel mills. 3. Major Iron Ore Miners in IndiaNational Mineral Development Corporation Limited (NMDC) is the largest iron ore producer in India. Its iron ore is mainly mined from the large - scale Bailadila integrated mining area in Chhattisgarh province and the large - scale Donimalai mining area in Karnataka province. In terms of production proportion, NMDC produced 30.77 million tons in the natural year 2021, accounting for 16.3% of India's national output (data from the World Steel Association). NMDC plans to increase its annual iron ore output from 45 million tons in the fiscal year 2024 to 67 million tons in the fiscal year 2025, and finally achieve a production target of 100 million tons by 2030. This increase in production is expected to increase its market share in India's iron ore market from 20% to 25%. IV. Key Investments in India's Steel Industry1. Significant Increase in JSW Steel's Production CapacityIn 2024, JSW Steel, a subsidiary of India's JSW Group, witnessed a remarkable expansion of its production capacity. In March, the company commissioned a hot - rolled strip mill with an annual production capacity of 5 million tons, injecting new vitality into the market. In April, the first continuous casting machine was successfully put into operation, with an annual production capacity of 2.5 million tons, further enhancing JSW's production capabilities. By the end of May, JSW launched the third - phase capacity expansion plan at its Dolvi steel plant in Maharashtra, aiming to increase the existing crude steel production capacity from 10 million tons per year to 15 million tons per year. This move will undoubtedly significantly boost the company's overall production capacity. At the end of July, JSW commissioned a converter at its Vijayanagar steel plant in Karnataka and planned to start a sintering plant simultaneously to meet the ever - growing market demand. JSW Steel has been continuously expanding, building new steel plants, starting new blast furnaces, and acquiring new iron mines. The company announced a series of important developments. To further enhance its production capacity, JSW decided to build a new steel plant in Odisha and start a new blast furnace. In addition, to ensure the supply of raw materials, JSW also plans to acquire new iron mines in the region. This series of measures demonstrates JSW's firm steps in continuously expanding its scale and optimizing its industrial chain. In September 2024, JSW Steel commissioned a new blast furnace with an annual production capacity of up to 5 million tons at its Vijayanagar steel plant in Karnataka to increase the plant's production capacity. In October 2024, JSW collaborated with South Korea's POSCO Group to jointly plan the establishment of a joint - venture steel plant in India. It is expected that this project will have an annual production capacity of 5 million tons in the initial stage. To ensure the supply of raw materials for blast furnace ironmaking, JSW actively participated in the government's public auction in November and successfully won the Codli iron mine in Goa at a premium rate of 62.6%. The iron mine covers an area of about 377 hectares and has resource reserves of about 48.49 million tons. It mainly produces medium - grade iron fines and lump ore, with iron grades of about 57.86% and 56.24% respectively. As an important member of the JSW Group in India, JSW Steel is not only one of the largest steel companies in India but also occupies a place in the global steel industry. Its steelmaking production capacity (covering both Indian and overseas businesses) in the fiscal year 2023/24 reached 29.7 million tons, and it plans to continue expanding its scale in the coming years. By the fiscal year 2024/25, the production capacity is expected to increase to 38.2 million tons, and by the fiscal year 2030/31, it is even expected to reach 51.5 million tons. These measures will undoubtedly help JSW achieve its ambitious goal of production capacity growth. India's Godawari Power and Ispat (GPIL) has obtained permission from the Chhattisgarh government to expand the iron ore pellet plant in Raipur, increasing the production capacity from 2.7 million tons per year to 4.7 million tons per year. This expansion project is expected to officially start in the first quarter of the fiscal year 2026. 2. Blast Furnace Ignition at Tata Steel's Kalinganagar Steel PlantTata Steel's steel plant in Kalinganagar has reached an important milestone - its blast furnace was successfully ignited and put into production. This event marks that the steel plant has officially entered a new stage of production, and it is expected to further increase the company's production capacity. The second - phase expansion project of Tata Steel's Kalinganagar steel plant is progressing steadily. The total investment in this expansion project is as high as 270 billion rupees (about 3.24 billion US dollars). Statistical data shows that in the past decade, Tata Steel's cumulative investment in the Kalinganagar steel plant has exceeded 1 trillion rupees. In addition, the second - phase expansion project will also cover the construction of key facilities such as pellet plants, coke ovens, and cold - rolling mills. At present, the Kalinganagar steel plant already has a complete set of production facilities, including a sintering plant with an annual output of 5.75 million tons, a coking plant with an annual output of 1.65 million tons, a blast furnace for ironmaking with an annual output of 3.3 million tons, a converter steelmaking workshop with an annual output of 3 million tons, and a hot - rolled strip mill with an annual output of 3.5 million tons. 3. RINL Restarts No. 3 Blast FurnaceIndia's Rashtriya Ispat Nigam Limited (RINL) reached a cooperation with Jindal Steel and Power Limited (JSPL), a steel and power company, and planned to restart its No. 3 blast furnace. This restart is expected to increase the annual production of hot metal by 2 million tons. It is worth mentioning that this blast furnace was suspended from production in January 2021 due to the rising cost of coking coal. According to the agreement, JSPL will provide about 8 - 9 billion rupees (equivalent to 690 - 770 million yuan) of pre - paid operating funds and ensure the continuous supply of raw materials required by No. 3 blast furnace to support its restart and long - term operation. 4. AMNS Plans to Build a New Steel PlantIndia's mining company AMNS, located in Andhra Pradesh, announced a major plan: to build a steel plant with an annual production capacity of [missing data] million tons in the region. This move aims to respond to the Indian government's grand blueprint for the development of the steel industry and further promote the increase of domestic crude steel production capacity. 5. ArcelorMittal Nippon Steel India Plans to Build an Integrated Steel PlantArcelorMittal Nippon Steel (AMNS) India plans to invest 1.4 trillion Indian rupees (about 16.6 billion US dollars) in Andhra Pradesh to build an integrated steel plant with an annual production capacity of 17.8 million tons. This project will be implemented in two phases. First, AMNS will invest 800 billion rupees to build a blast furnace with an annual production capacity of 7.3 million tons. At present, the company has started looking for suitable construction land. Subsequently, in the second phase, AMNS plans to invest another 600 billion rupees to further increase the steel plant's production capacity to 17.8 million tons. It is expected that the construction of this project will start in early 2025. 6. JSPL Plans to Increase Angul Steel Plant's Capacity to 12 Million Tons per YearJSPL Steel announced that it plans to expand its Angul steel plant in Odisha. It is expected that next year, the annual production capacity of this steel plant will be increased from the current 6 million tons to 12 million tons. Moreover, the company also looks forward to further increasing the production capacity to 25 million tons per year within the next six years. This series of expansion plans demonstrates JSPL's firm determination in increasing production capacity and optimizing the production layout. 7. LME's Capacity Expansion PlanLloyd Metal and Energy (LME) has formulated an ambitious capacity expansion plan. They plan to add a direct - reduced iron production equipment with an annual output of 360,000 tons at the Ghugus plant in the Chandrapur area and build two new 30 - megawatt power plants, with the related construction starting in March 2025. In addition, LME plans to build a pellet plant with an annual production capacity of 4 million tons at the Kondsari plant in the Kaddicherla area. This plant is scheduled to be put into operation in March 2025, and the second pellet plant is expected to be put into operation in June 2026. Between September 2028 and March 2029, the company will also put into operation an integrated steel plant equipped with two blast furnaces (with a total annual production capacity of 3 million tons), a converter with an annual production capacity of 3 million tons, and coating equipment required for the production of galvanized hot - rolled coils and cold - rolled coils. V. Key Factors Driving the Development of India's Steel IndustryThe rapid development of India's steel industry is due to the combined effect of multiple driving factors.

VI. Challenges Faced by India's Steel IndustryDespite the remarkable achievements of India's steel industry, it still faces some challenges.

VII. Future Development Trends of the Indian Steel IndustryLooking ahead, the Indian steel industry will continue to maintain a strong growth momentum.

VIII. ConclusionIn conclusion, the Indian steel industry has achieved remarkable results in recent years, but it still faces some challenges. In the future, with the continuous growth of the Indian economy, the continuous advancement of infrastructure construction, and the promotion of technological innovation and digital transformation, the Indian steel industry will continue to maintain a strong growth momentum and is expected to occupy a more important position in the global steel market. Sinosteel Stainless Steel Pipe is the Manufacturer and Supplier of Stainless

Steel Pipe and Special Alloy Pipe, Steel pipes with an outer diameter from

8mm to 3600mm, with wall thicknesses from 0.2mm to 120mm. Factory covering an area of

333,000 square meters. Production capacity reaches 200,000 tons. | |